11 Nov 2021 The rise of the middle class in Asia

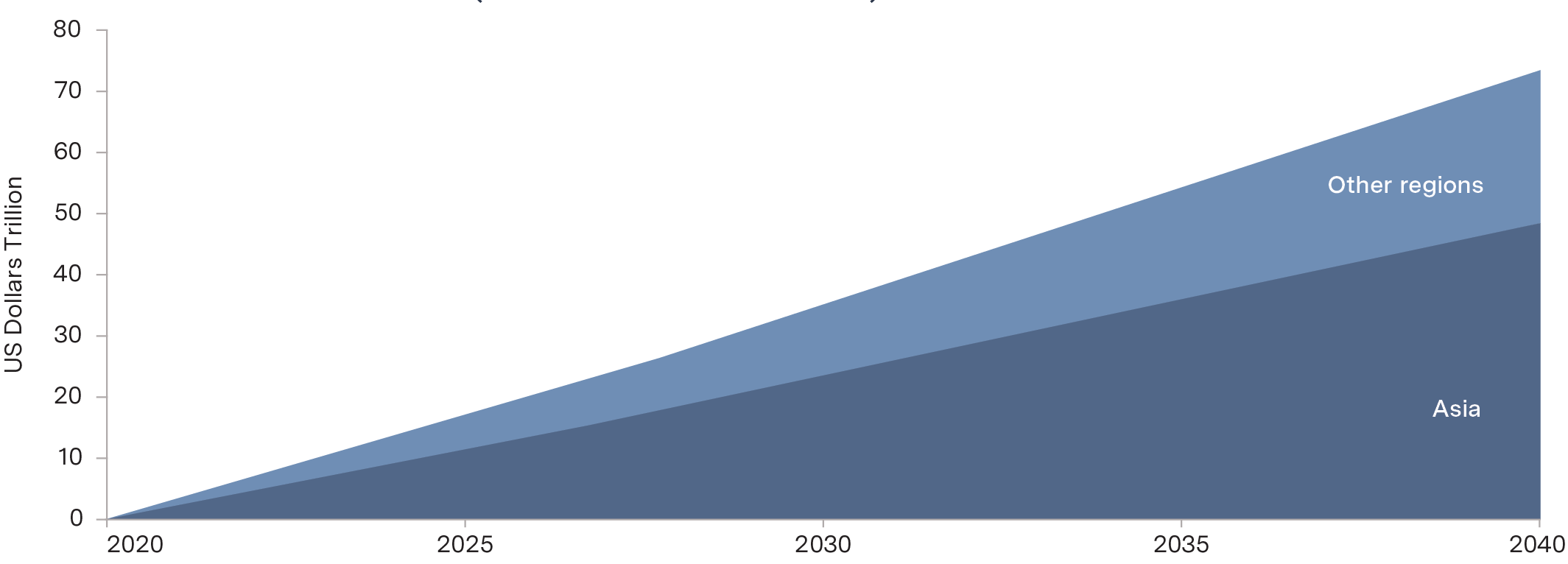

Asia is at an inflection point too important to ignore. It is already the world’s largest economic region and is forecast to deliver around two thirds of global growth over the next two decades.

More importantly, from an investment perspective, the region is also seeing a transition due to the dramatic rise of its middle-class. This is driving a shift in demand, which has historically focused on commoditised products, towards more sophisticated services. We believe that some companies with sustainable competitive advantages in these areas will be able to generate significant earnings growth and valuation expansion. With Asia expected to account for 65% of the world’s middle class by 2030, these trends present opportunities that are too important to ignore.

With this shift, traditional plays on Asian growth, such as Australian resources and materials stocks, may no longer be as effective in gaining exposure to the attractive growth on offer in these markets. We think investors should consider allocations that target Asia’s increasingly sophisticated consumption patterns. Be this in sectors like e-commerce, where some Asian companies are at the forefront of global online consumption trends, or in healthcare, where Asian nations are increasingly able to fund cutting-edge treatment for their vast populations. At VGI Partners, we search for companies that are leveraged to this growth. It is clear to us that an increasing number of the best opportunities globally will be found either in Asia or in companies with high exposure to the region but listed in other markets.

Contribution to Global GDP Growth (Cumulative US Dollars Trillion)

Source: OECD Real Long-Term GDP Forecasts and VGI Partners

The forefront of e-commerce

Asia already accounts for around 60% of the world’s online retail sales and the regions’ e-commerce consumption story has only just begun.

Given the high propensity towards e-channels, and strong growth in consumption, it is not hard to see where many of the technology giants of the future will be based.

Many of Asia’s key e-commerce markets are dominated by domestic players that have established strong network effects and a sticky customer base. This means investors cannot just rely on Western technology companies to access the Asian growth outlook. To truly understand the regions e-commerce opportunities, investors need to understand the unique nature of each market and be able to assess the risk-reward with a long-term frame of mind.

One structural trend we are closely following in the region is the rapid rise in digital payments. Many Asian consumers are embracing payment services offered directly by the e-commerce platforms such as e-wallets and QR-enabled solutions. These services not only bring additional revenue streams for the platforms, from transaction fees, but also enhance their overall fly-wheel effects. With customer rewards and financing options further encouraging consumers to use the e-commerce ecosystem for purchases.

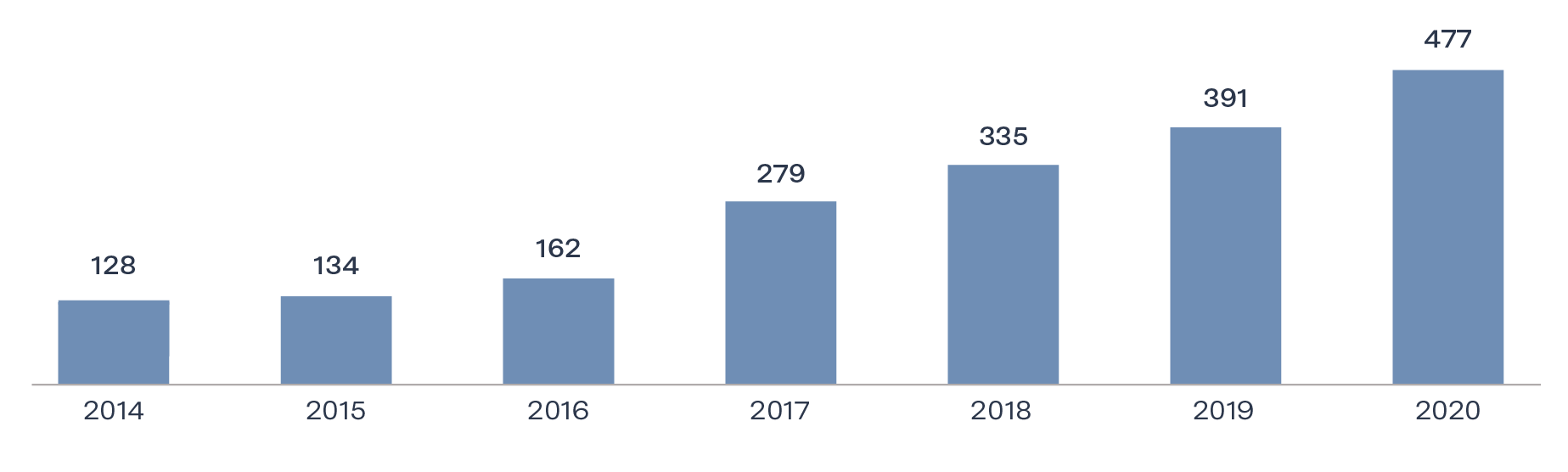

Capgemini forecasts the Asia Pacific region will see growth rates in “non-cash” transaction volumes, which include digital payments, as dramatically outpacing other regions over coming years. We feel the Asian e-commerce platforms that can capture this growth are well placed to generate enhanced earnings growth.

Worldwide non-cash transactions volume (USD billions)

*Non-cash transaction data for 2000 is sourced from countries’ central banks. In case of data unavailability forecasted figures are used. Figures are forecasted for 2021 and beyond.

Source: Capgemini Financial Services Australia, ECB Statistical Data Warehouse, BIS Statistics Explorer, countries’ central bank annual reports.

Investors can access growth in Asia via stocks listed in mature markets

Accessing the rising Asian consumer does not necessarily mean investors have to invest in stocks listed in less developed financial markets. Japan, for example, has a highly robust regulatory system and a broad range of listed companies with significant exposure to other rapidly growing Asian economies.

There are other factors that also have us paying particularly close attention to some of these Japanese opportunities. While many Japanese companies have a reputation for providing superior products to their customers, some have been less focused on optimising profit margins for the benefit of shareholders or in paying dividends commensurate with their profits and accrued cash savings.

There is now a clear shift in mindset among Japanese corporates who are increasingly taking shareholders into account. We believe this can unlock value and significantly raise the price of the underlying shares.

Olympus is just one example of a high-quality Japanese company that is well positioned to benefit from a rising Asian middle-class and unlock significant value from shift in mindset towards prioritising shareholders. Olympus is the world leader in gastrointestinal endoscopes, with 70% market share globally. The company has spent decades providing training programs for surgeons on its equipment, in both developed and developing markets.

This has created a sticky customer base of customers that face a high switching cost as shifting to alternative endoscopic equipment would involve time away from the operating table to retrain. As Asia’s middle-class expands, we expect to see a dramatic increase in the number of patients that can afford to receive endoscopic surgery. For perspective, the region is expected to add around one and a half billion people to its middle-class this decade alone.

Olympus has also seen a change in leadership over recent years with new management embracing reform and committing to a 20% EBIT margin target. A rise in gastrointestinal endoscope sales, which come with a roughly 25% EBIT margin, will certainly help lift the low-teen company EBIT margin. This is further helped by the recent sale of the poorly performing camera division and the shift of some medical device production to lower cost geographies.

Olympus is also investing in the right areas, by expanding its own endoscope consumables product portfolio across all key categories and reducing its use of partner suppliers for consumables. As its endoscope sales increase in Asia, the company will now be well positioned to generate a higher recurring consumables sales ratio and higher returns on invested capital.

Part of the reform at Olympus has been facilitate by the sale of its camera division to a private equity fund. These funds are often far better placed to restructure poor performing businesses and merge them with units spun off from other competitors. With record amounts of capital available for private equity funds to put to work it is likely this Asian restructuring tailwind has only just begun.

Unspent private equity capital of Asia-Pacific-focused funds at year-end (US Dollar Billions)

Notes: Growth for 2017-20 partly reflects greater coverage from the data supplier in China

Source: Preqin

Exposure to Asian growth can also be found in companies listed outside of Asia

Some markets in Asia present higher risks than others. One of the best practices for managing risk in Asia is to focus on long positions in quality businesses with a margin of safety in the valuation. We also aim to generate returns by shorting low-quality businesses that appear materially overvalued.

In looking for attractive ways to gain exposure to Asian growth VGI Partners’ does not constrain itself to only investing in companies listed in Asia. Richemont, for example, is listed in Switzerland but has a high exposure to Asian consumption in its luxury jewellery and watch brands (which include names like Cartier, Van Cleef & Arpels, Panerai and IWC). Richemont’s Asia Pacific sales last year were double that of its home European market.

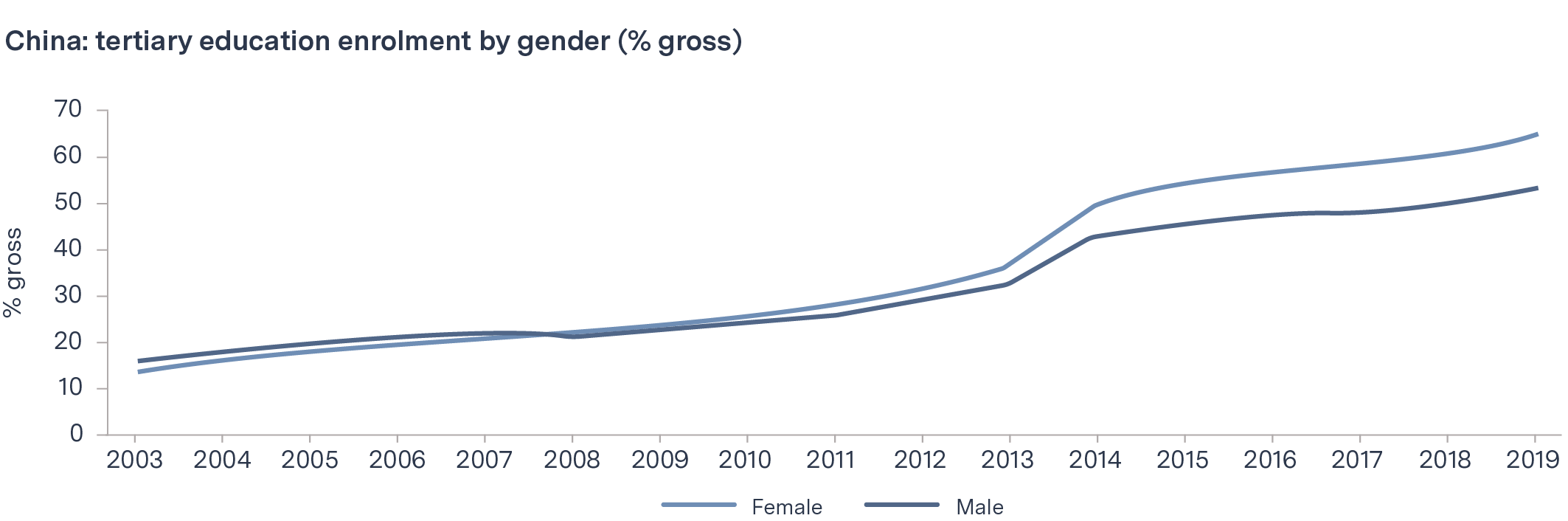

We see Richemont as well positioned for an ongoing structural shift in consumption patterns. Female participation in higher education has increased dramatically in absolute and relative terms in the past two decades. This is coinciding with higher growth rates in female incomes and an increasing skew towards female purchases of jewellery.

Higher female tertiary education rates bode well for future growth in luxury consumption

Source: World Bank, Morgan Stanley Research

Key takeaways

- With Asia forecast to contribute most of the world’s GDP growth in the decades to come, and a shift toward middle-class consumption, it makes sense for long-term investors to increase allocations in areas that will benefit directly.

- Asia is also increasingly at the forefront of new trends and likely to produce many of the world leaders of tomorrow.

- Investors can balance risk-reward by looking for investment opportunities listed in developed markets that have appealing exposures to the Asian growth drivers.

- VGI Partners will continue to focus on finding the best opportunities to leverage this growth globally, while managing the risks that are unique to Asia.

Subscribe for more insights >

Insights gives readers access to general information and our investment beliefs only, and without taking into account any particular reader’s objectives, financial situation or needs. The purpose of providing the information is not to provide financial product advice and the information does not contain a recommendation or statement of opinion intended to be investment advice or to influence a decision to deal with any financial product not does it constitute an offer, solicitation or commitment by VGI Partners, VG1 or VG8.

VGI Partners Limited (ABN 33 129 188 450) (VGI Partners) (Australian Financial Services Licence No. 321789 SEC CIK No. 0001577774). VGI Partners is the manager of VGI Partners Global Investments Limited (VG1) (ABN 91 619 660 721). VGI Partners Asian Investments Management Pty Ltd (ABN 84 635 179 538), a subsidiary of VGI Partners, is the manager of VGI Partners Asian Investments Limited (VG8) (ABN 58 635 219 484). Before viewing any of the information in this document or the papers, articles and/or videos referred to in this document you should carefully review the disclaimers set out therein and consider whether the information is right for you. Before making any financial decisions, you should consider obtaining your own financial product advice from an ASIC licensed adviser.