16 Dec 2021 Five global trends point to buys and sells for 2022

This article was published by Firstlinks

Many of our holdings are not well known in the Australian market, and we also own familiar global brands not likely to be held by most Australian investors. While the Australian Securities Exchange (ASX) ranks in the Top 20 of major global exchanges with a market capitalisation around US$2 trillion, it is dwarfed by the leaders, such as the New York Stock Exchange at about US$27 trillion and NASDAQ at US$24 trillion. Australia represents less than 2% of listed global company opportunities.

Consequently, there are many industries and themes not available to investors who focus only on the ASX, such as in the leading global tech, health and consumer brands. Even where a similar business exists in Australia, the global company is often operating on a significantly higher scale in many more markets.

This article focuses on five opportunities, three buys and two sells based on expected market developments for 2022 building on themes now opening.

Chicago Mercantile Exchange (CME) and US stimulus spending

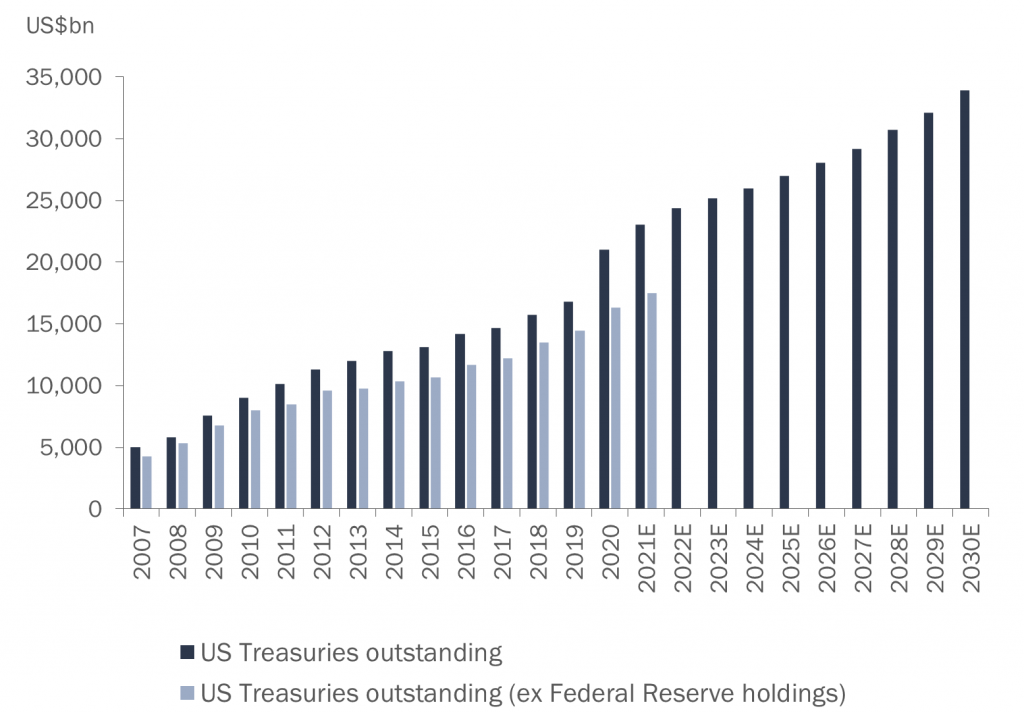

CME is a derivatives exchange with an effective monopoly in trading of US interest rate derivatives. It also operates a dominant position in trading commodities, foreign exchange and energy derivatives. We believe the record level of issuance of US Treasury bonds to fund stimulus spending provides a future tailwind for interest rate derivatives and volatility trading.

The anticipated upside is hidden in future earnings, and the trigger for the earnings power will be an acceleration in interest rate increases and volatility in 2022. CME is ideally positioned to take fees from this activity as well as the ongoing issuance growth of US Treasuries, as shown below.

Size of the US Treasury Market (2007-2030E)

Source: Congressional Budget Office, Redburn

Qualtrics and easy use of data

Qualtrics is a cloud software business and the leader in a category called Customer Experience Management. Businesses today are faced with a growing wave of data, whether from customers, employees, or data about specific brands within a product portfolio. And all this data is flowing in from different channels, such as social media posts, inbound emails, customer service interactions, or survey responses. Qualtrics takes all of this unstructured data, analyses it and presents it on a user-friendly platform so that executives can quickly check customer or employee feedback or use real-time insights to make decisions.

A good example is JetBlue airlines, a major US low-cost airline which uses the platform to analyse customer feedback and better tailor pricing for flights. It also improves the inflight experience and enhances net promoter scores, and ultimately increases customer retention.

Qualtrics is the leader in this market with around 14,000 customers and by far the largest player. In fact, 85% of Fortune 100 companies are customers. As an enterprise Software as a Service (SaaS) solution, the revenue model is highly scalable and profitable with strong recurring revenues based on the number of modules that a customer wants.

The chart below shows how a business maps out customer feedback data, or employee feedback data, or more information about a specific brand. Existing customers are on average increasing the spend with Qualtrics by over 20% each year. We think this type of software, and this category of customer experience management, is mission critical for businesses that need to better understand their customers and employees and then adapt in real time. Increasingly, investors will appreciate the long runway of growth, and the business is starting to generate significant free cash flow, despite ongoing investments in the software.

Source: Qualtrics

Mercari and online marketplaces

Turning to our Asian portfolio, Mercari is Japan’s leading marketplace to buy and sell second-hand products online, anything from clothes to electronics to toys. They have made the online experience seamless, both in terms of listing products for buyers and sellers and also in terms of shipping and delivering items. Now with 20 million monthly active users in Japan, Mercari is used by one in six Japanese individuals each month and has become pervasive throughout society in Japan.

As Mercari grows, it attracts more sellers and buyers creating a classic network-effect flywheel. The business model is capital-light, scalable, and has winner-take-all economics, which has allowed it to capture over 60% market share in the second-hand goods market in Japan. It is so dominant in Japan that the company estimates that products sold on the Mercari platform account for 5% to 10% of all Japanese home delivery parcels. The domestic business is highly profitable and cash flow generative, which is allowing the business to reinvest into new growth opportunities. One of these is in digital payments, including Buy Now Pay Later services. It has also expanded overseas, particularly in the US, where it has launched a similar second-hand goods marketplace that now captures about US$1 billion a year on transactions with almost 5 million monthly active users.

Now let’s consider two shorting or selling thematics.

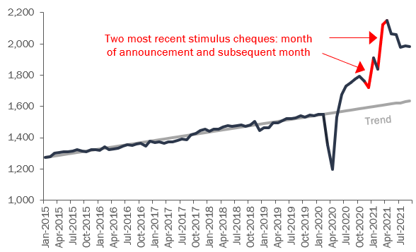

Personal consumer goods

First, there has been a substantial surge in durable goods consumption in the US in the last year. As households, unable to spend on services such as restaurant and travel, have funneled more expenditure into goods. This trend was amplified by US stimulus checks handed directly to households, and some stock valuations now appear to be pricing in a new paradigm of the recent growth rates and margin expansion continuing.

However, consumption is reverting towards trend as services consumption picks back up. People will return to restaurant and travel, and the inventory levels for some of the consumer companies are extremely elevated, which will be priced to clear at some stage.

US durable goods personal consumption expenditure (US$ bn seasonally adjusted annual rate)

Source: US Bureau of Economic Analysis. Trend has been extrapolated from 2015-2019 actual data

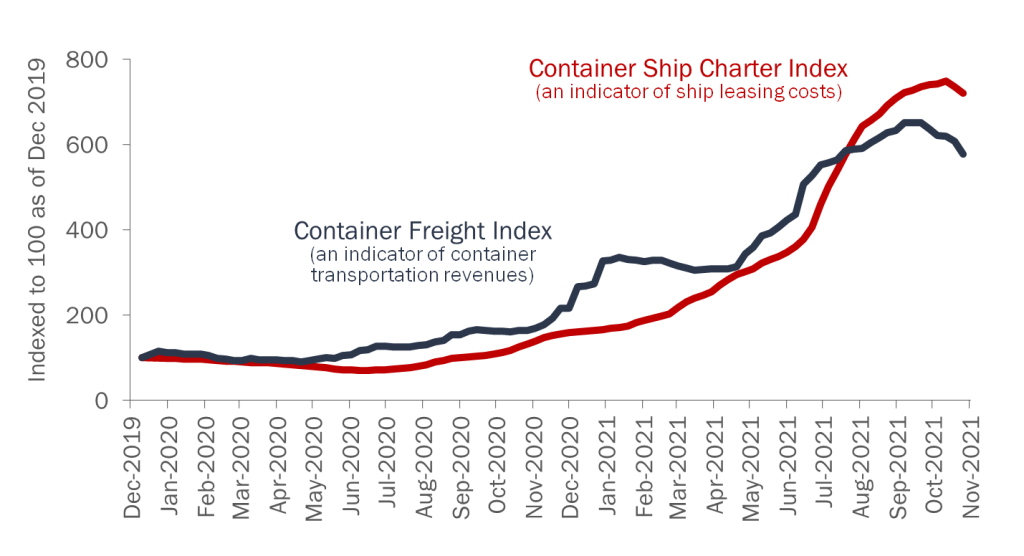

Container shipping lines

The consumer trends are also feeding through in container shipping lines. Again, the huge surge in durable goods consumption in the US led to an overwhelming order flow for Asian manufacturers and a massive strain on supply chains. Amplified by COVID delays, this led to ships anchored in ports and an increase in freight rates. Now, the high frequency forecasts that we track based on actual container bookings show this inflow is starting to slow.

Meanwhile, measures to improve the supply chain have led to a 30% decline in the number of containers stuck on the Port of Los Angeles docks (a key pinch point) over recent months. Indeed, the CEO of the Long Beach Harbor Trucking Association suggests that cargo showing up in the docks is moving quickly. While Walmart, the largest retailer in the US, reports an increase in throughput over the last 4 weeks of about 26% nationally in terms of getting containers through ports. The chart below shows the early signs of this impact on the Container Ship Charter Index, which is an indicator of revenue for the shipping lines.

Ship charter costs have grown more than freight prices since 2019

Source: WCI Composite Container Freight Benchmark Rate per 40 foot box, Container Ship Time Charter Assessment Index (both via Bloomberg).

Many people in the market don’t understand that a key cost indicator for the shipping lines, the charter rates they pay to lease ships, have risen to record levels. These elevated charter costs are now being locked in on average for two years. This may lead to an earner squeeze which is not priced into current elevated valuations.

That’s a brief overview of two areas we find appealing for shorts, but it also shows key trends which will affect many parts of the global economy.

Operating a fund with both long and short capacity gives portfolio managers the ability to back good investments while benefitting from declining thematics and companies. Of course, in a strong market, the shorts can be challenged by the sheer momentum of the market, which requires a patient approach for strategies to pay off over the long run.

Subscribe for more insights >

Insights gives readers access to general information and our investment beliefs only, and without taking into account any particular reader’s objectives, financial situation or needs. The purpose of providing the information is not to provide financial product advice and the information does not contain a recommendation or statement of opinion intended to be investment advice or to influence a decision to deal with any financial product not does it constitute an offer, solicitation or commitment by VGI Partners, VG1 or VG8.